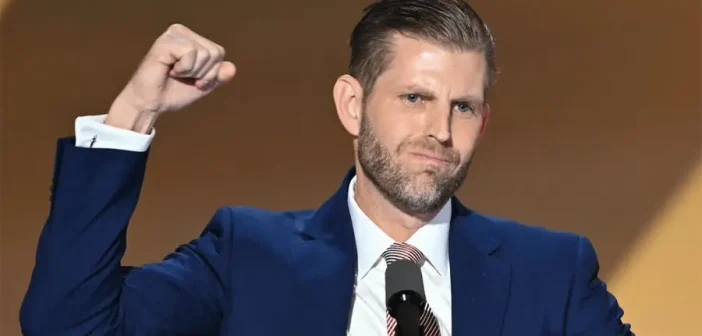

The Eric Trump blockchain warning is making waves across the financial sector. In an interview with CNBC, Trump stated that traditional banks risk disappearing by 2035 unless they embrace blockchain technology.

Eric Trump Blockchain Warning Sparks Urgency for Banks

As the executive vice president of the Trump Organization, Eric Trump didn’t hold back in his critique. He called the SWIFT interbank messaging system “an absolute disaster,” blaming it for slow and outdated processes in global banking. Trump emphasized that banks serve the ultra-rich while neglecting the broader population.

He added that traditional banking is no longer competitive in the face of blockchain and crypto-based innovations.

“If banks don’t keep up with innovation, they’ll be gone in 10 years,” said Trump.

DeFi Could Replace Traditional Banking

Eric Trump highlighted decentralized finance (DeFi) platforms as a superior alternative to legacy financial institutions. He explained that DeFi enables fast peer-to-peer transactions with little to no fees—unlike banks, which rely on high fees for profit.

“You can now use a DeFi app to send money wallet-to-wallet instantly, without depending on the changing policies of a bank,” he said.

Trump’s Broader Crypto Vision for the U.S.

This isn’t Trump’s first foray into crypto advocacy. In January, he revealed that the White House plans to remove capital gains taxes for U.S.-registered crypto companies. He also expressed confidence that the U.S. could become the world’s leading crypto hub by promoting clearer, business-friendly regulation.

As banks face increasing pressure to modernize, Eric Trump’s blockchain call serves as a wake-up call to financial institutions worldwide.