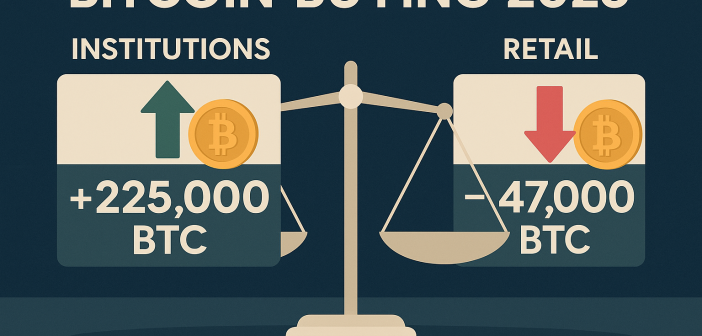

Bitcoin buying 2025 trends reveal a striking imbalance between institutional and retail behavior. According to a detailed report from investment firm River, corporations, governments, and funds significantly increased their Bitcoin holdings throughout the year, while private individuals moved in the opposite direction — selling off large amounts of BTC.

This dynamic shift in ownership not only prevented downward pressure on prices but also supported the cryptocurrency’s 10% year-to-date growth.

Bitcoin Buying 2025 Data Shows Institutional Demand

River’s blockchain analysis shows that in 2025:

-

Commercial organizations accumulated 157,000 BTC, worth approximately $16 billion

-

ETFs and funds added another 49,000 BTC (≈$5 billion)

-

Governments acquired 19,000 BTC (≈$1.9 billion)

-

Retail users, by contrast, sold off 247,000 BTC (≈$25.3 billion)

These numbers clearly illustrate that Bitcoin buying in 2025 was driven by institutions. They absorbed nearly all the BTC offloaded by individuals, acting as a buffer against market volatility.

Despite intense retail selling pressure, Bitcoin’s price remained resilient, largely due to this influx of long-term corporate buying.

Why Individuals Sold as Institutions Bought

Retail investors likely sold to realize profits after previous price gains. In contrast, corporate entities pursued long-term strategies. These firms weren’t just looking to capitalize on short-term price moves — many of them view Bitcoin as a long-term asset with strategic value.

The report from River also shows that the number of institutions using Bitcoin increased by a staggering 154% in 2025. Most of these new adopters operate in finance, technology, and consulting — sectors known for innovation and adaptability.

This broader trend of corporate BTC investment represents more than portfolio rebalancing. It reflects a shift in how businesses engage with digital assets.

Bitcoin Buying 2025: Beyond Investment

What makes 2025 especially notable is that many companies didn’t just buy BTC to hold it on balance sheets. They also integrated it into operations.

River highlights multiple cases where businesses adopted Bitcoin for:

-

Internal financial flows and cross-border payments

-

Treasury reserve diversification

-

Client-facing financial products or services

This move from speculation to institutional Bitcoin use reflects a maturing view of cryptocurrency’s utility.

By embedding Bitcoin into workflows, companies demonstrate increased trust in its long-term viability — regardless of short-term price movements. As a result, the market grows more stable and less prone to panic cycles driven by retail selling.

Corporate Accumulation Outpaces Individual Selling

Perhaps the most telling signal of the year is that corporate BTC investment neutralized the impact of widespread individual sell-offs. Institutions quietly accumulated coins that retail investors offloaded — and in doing so, contributed to market stability and price strength.

This explains why Bitcoin rose around 10% year-to-date despite significant selling activity from private holders. Institutional presence didn’t just offset volatility — it also provided new capital and confidence to the ecosystem.

Final Thoughts: Bitcoin Buying 2025 Reshaped the Market

Bitcoin buying 2025 has clearly defined a new era. Retail users may still trade short-term swings, but corporations, funds, and even governments are building long-term positions.

This change in behavior — from trading to holding, from speculation to integration — reflects the growing role of Bitcoin in the global financial landscape. With institutional buyers stepping in as the new foundation of the market, Bitcoin’s long-term outlook appears stronger than ever.