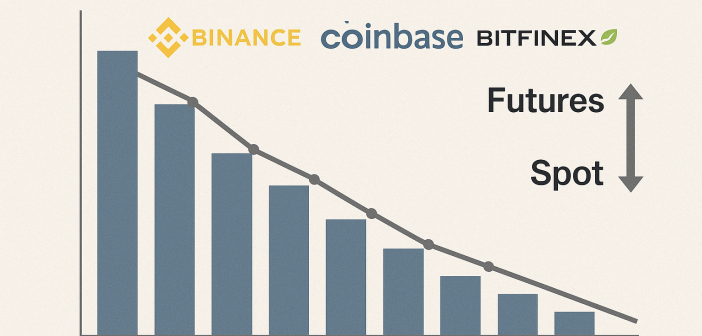

Crypto trading volume on major exchanges have dropped to their lowest point in six months, according to a report by The Block. The decline highlights a growing preference among traders for futures markets over spot trading.

As of Saturday, April 19, the seven-day moving average of trading volume on leading exchanges like Binance, Coinbase, and Bitfinex fell to just over $32 billion. This is the lowest level since mid-October 2024 and marks a dramatic 75% decline from the December 2024 peak of $132 billion.

Shift to Futures Dominates Market Trends

Traders are increasingly favoring speculative futures trading, which often involves leverage and allows for short-term strategies. The spot-to-futures trading ratio for Bitcoin has dropped to 0.19, meaning spot volume is just 19% of futures. This is the lowest level since August 2024. Ethereum’s ratio sits at 0.20, also the lowest since December 2023.

This significant drop in spot trading suggests reduced real demand for cryptocurrencies in favor of high-risk, leveraged trades. According to analysts, this could indicate a more speculative phase in the crypto market cycle.

DeFi and ETFs Show Similar Trends

Volumes on decentralized exchanges (DEXs) have also declined and are likely to mark the lowest monthly total since October 2024. Spot crypto ETFs are not immune to the trend either. On Thursday, April 17, trading volume in spot Bitcoin ETFs hit the lowest since March 25, while Ethereum ETFs dropped to levels last seen on March 27.

Despite the general market downturn, Solana (SOL) has shown a minor recovery in weekly trading volume, surpassing Ethereum. This reversed a downtrend seen from January to March 2025.

Bitcoin Price Rallies Slightly

In contrast to falling volumes, Bitcoin’s price rose at the start of the week. As of 17:40 MSK on April 20, BTC was trading at around $88,200, its highest level since early April, with a 4.3% gain in the last 24 hours.