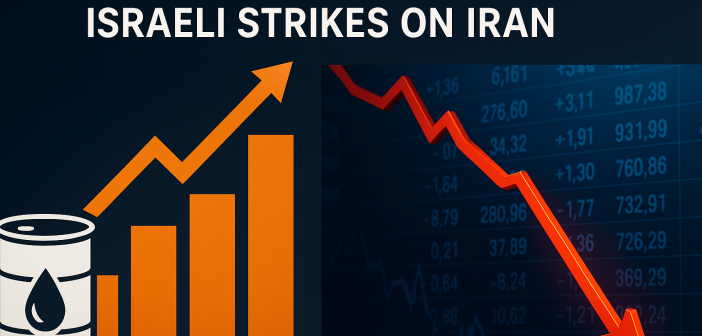

On June 13, 2025, global financial markets experienced significant volatility following Israel’s military strikes on Iranian nuclear and military facilities. The escalation in Middle East tensions prompted a surge in oil prices and a decline in stock futures, as investors sought safer assets amid growing geopolitical uncertainty.

Oil Prices Soar

Brent crude oil prices jumped over 9% to $75.55 per barrel, while West Texas Intermediate (WTI) crude rose by 7.3% to $72.91. The spike reflects concerns over potential disruptions to oil supplies, particularly through the Strait of Hormuz, a critical chokepoint for global energy transportation.

Stock Futures Decline

U.S. stock futures indicated a negative opening, with Dow Jones Industrial Average futures down nearly 700 points and S&P 500 futures falling by 1.8%. European and Asian markets also faced declines, as the prospect of a broader conflict weighed on investor sentiment.

Flight to Safe-Haven Assets

In response to the heightened geopolitical risks, investors moved capital into traditional safe-haven assets. Gold prices increased by 1%, and the U.S. dollar strengthened against a basket of currencies. The Swiss franc and Japanese yen also saw gains, reflecting the global shift towards safer investments.

Economic Implications

Analysts warn that sustained high oil prices could lead to stagflation—a combination of stagnant economic growth and high inflation. Such a scenario poses challenges for central banks, which may need to balance inflation control with supporting economic activity.