The tokenized real-world assets (RWA) sector is steadily emerging as a cornerstone of the crypto economy. While hype around decentralized platforms may have cooled, the core concept—creating blockchain-based tokens backed by real assets—continues to gain traction, especially in light of rising interest in stablecoins and digital bonds.

Mantra’s Collapse Was a Wake-Up Call

The downfall of Mantra served as a major wake-up call for the RWA space. Investors and builders alike are now paying closer attention to the infrastructure behind these protocols. As Andrei Grachev of DWF Labs put it:

“Mantra’s failure was a turning point. It exposed serious flaws in permissionless RWA mechanics. Investors will be more cautious moving forward, and institutions will demand greater transparency and regulation.”

This has sparked a shift toward more legally grounded and transparent alternatives. There’s also growing debate about whether RWAs can act as a hedge against the overall volatility of crypto markets.

Edwin Mata, CEO of Brickken, added:

“RWAs with legal backing and real-world collateral behave more like traditional securities. They can serve as a stability layer, even in turbulent markets.”

Kadan Stadelmann, CTO of Komodo, echoed the sentiment:

“Institutional adoption of RWAs is the tipping point we’re heading toward. Aside from stablecoins, few other crypto assets are likely to receive similar regulatory approval.”

Top 4 RWA Tokens to Watch in May 2025

Ondo (ONDO)

Ondo has been climbing steadily, gaining nearly 14% over the past month and reclaiming the $1 mark for the first time since March. This upward movement comes despite a broader 17% drop in the RWA sector’s total value locked (TVL), now at $16.6 billion.

Technically, the presence of a death cross on the charts hints at a potential correction. Support lies around $0.866, with possible pullbacks to $0.819 or even $0.663. However, if ONDO breaks through $1.04, a rally toward $1.20 could follow. Institutional interest and real-world integration make Ondo one of the most closely watched RWA projects.

Reserve Rights (RSR)

RSR surged by nearly 41% over the past month, fueled by a Coinbase listing and rumors linking the project to Paul Atkins, a potential future SEC chairman. Even though Atkins isn’t officially involved, traders have been quick to speculate on potential regulatory advantages.

The token is now testing key resistance at $0.0096. A successful breakout could open up targets of $0.011 and $0.0137. Conversely, a rejection could see RSR dip back to $0.0071 or even $0.0057. After a long period of stagnation, RSR is showing signs of life—and renewed investor confidence.

TokenFi (TOKEN)

TokenFi is a newcomer in the RWA space but has already made waves with a 40% gain in just one week. Market cap is hovering around $20 million, although daily trading volume has dipped by nearly 60%, suggesting some caution is warranted.

From a technical standpoint, TOKEN is approaching major resistance levels. Continued interest could push it toward $0.0275 or even $0.041. But if momentum fades, support at $0.0194 and $0.0137 could come into play. Despite the risks, TokenFi remains one of the most dynamic entries in the RWA niche.

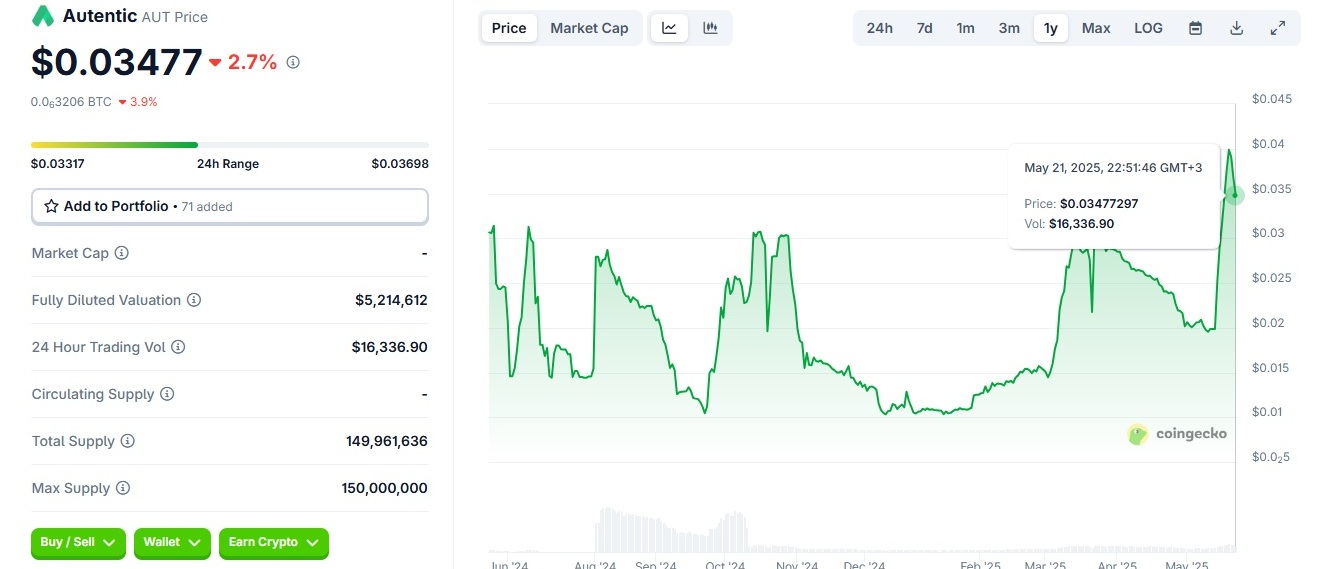

Autentic Capital (AUT)

The fourth pick on our list is AUT, the native token of the Autentic Capital platform. Focused on tokenizing real estate and other tangible assets, AUT has a fixed supply of 150 million tokens. It serves multiple functions within the ecosystem—including staking, governance, and fee payments.

What sets AUT apart is its integration with the TON blockchain, ensuring high-speed, low-cost transactions. The platform is actively expanding, with real-world use cases ranging from property rentals to investment via IDOs. Autentic also participates in major events like TOKEN2049 Dubai, building brand credibility and partnerships.

AUT stands out as a new-generation RWA token: legally compliant, transparently governed, and backed by real assets.

Currently priced around $0.035, AUT has gained over 34% in the past week and offers strong potential for both short-term traders and long-term investors.

The RWA sector is evolving rapidly. Weak players are being weeded out, while well-structured, regulation-ready projects are stepping into the spotlight. AUT, ONDO, RSR, and TOKEN aren’t just speculative coins—they represent the future of asset-backed finance on the blockchain. Keeping an eye on these four in May 2025 could be a smart move for forward-looking investors.